Table of Contents

- Social Security Benefits, Finances, and Policy Options: A Primer ...

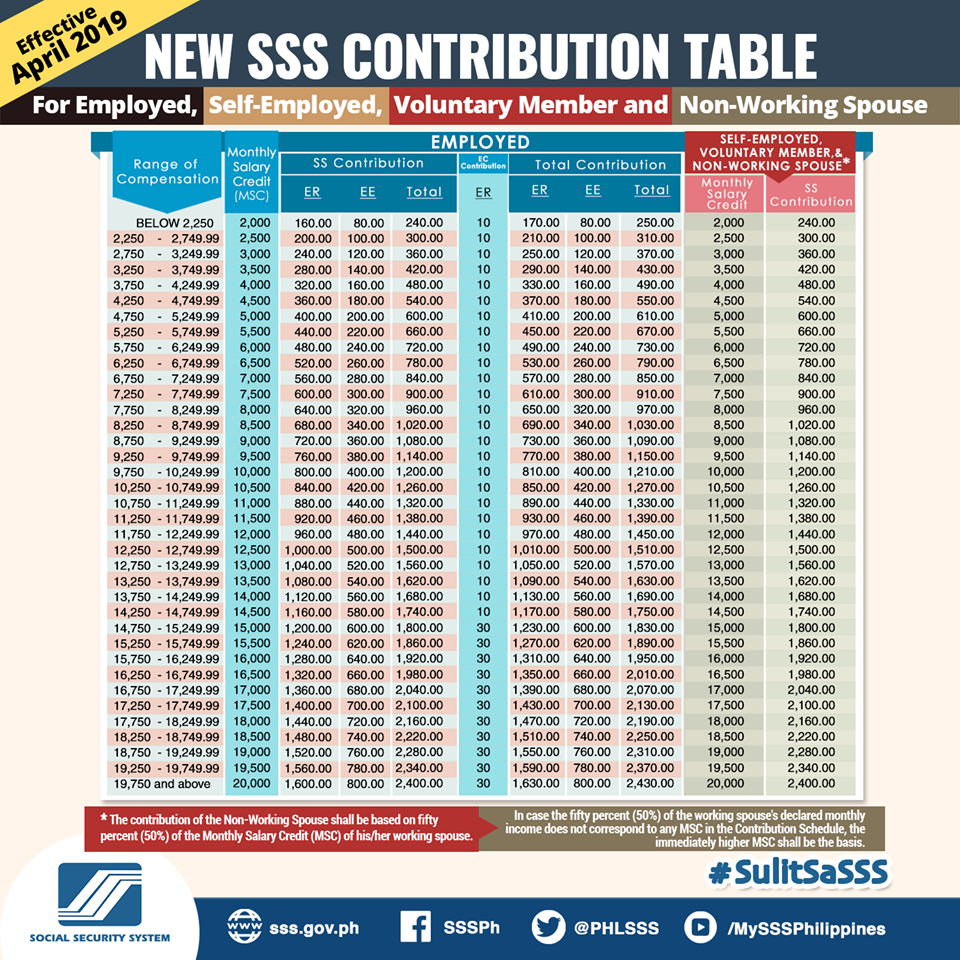

- Social Security Max 2024 Contribution - Toni Agretha

- 2026 Tax Brackets: Why Your Taxes Are Likely to Increase in 2026 and ...

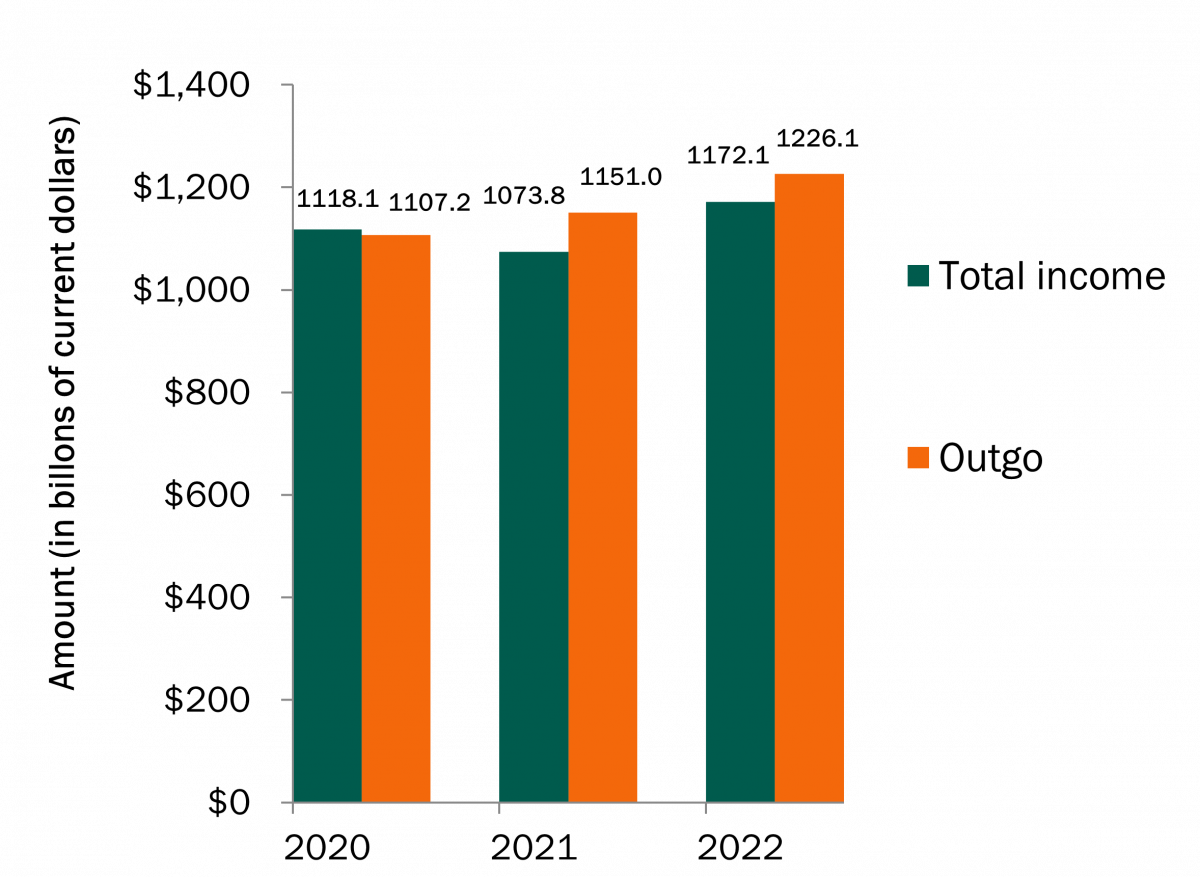

- Is Social Security Going Broke? - The Center For Garden State Families

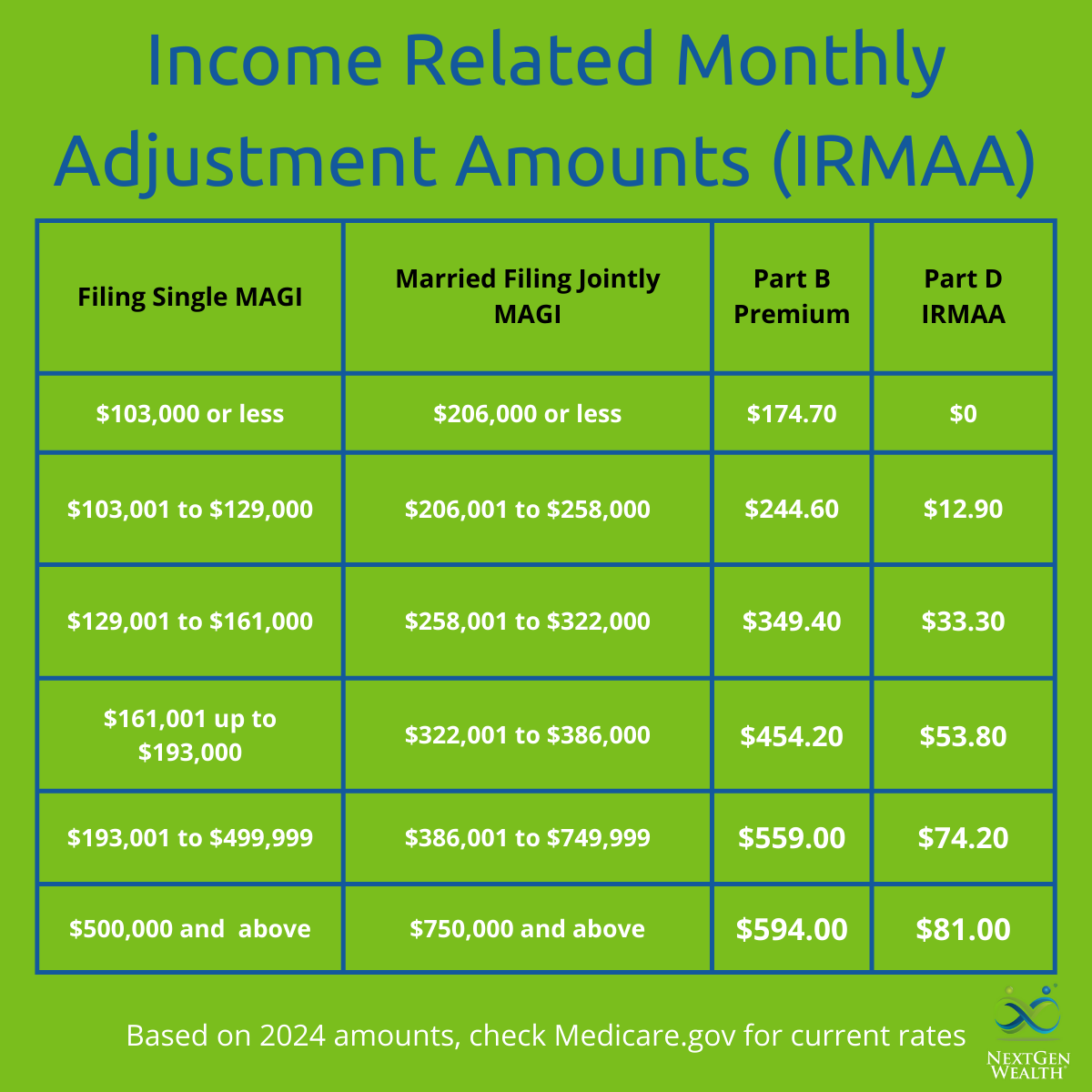

- What is the Income-Related Monthly Adjustment Amount (IRMAA)?

- Medicare Irmaa 2024 Chart - Sella Sophronia

- Estimated Federal Tax Brackets 2026 - Printable 2025 Monthly Calendars

- Is Social Security Going Broke? - The Center For Garden State Families

- Social Security Administration Proposes 2 Much-Needed Changes, But ...

- Ssa Income Limits Chart 2024 - Liuka Shannon

What are IRMAA Sliding Scale Tables?

POMS HI 01101.020: An Overview

How Do IRMAA Sliding Scale Tables Work?

The IRMAA sliding scale tables work by categorizing beneficiaries into different income levels, ranging from less than $88,000 to $500,000 or more. Each income level corresponds to a specific premium amount, which is a percentage of the total Medicare Part B and Part D premium. For example, beneficiaries with incomes between $88,000 and $111,000 will pay a higher premium than those with incomes below $88,000.

Key Points to Know

The IRMAA sliding scale tables are updated annually to reflect changes in the cost-of-living and other factors. Beneficiaries with higher incomes will pay more for their Medicare Part B and Part D premiums. The tables take into account the beneficiary's MAGI and the number of beneficiaries in the household. The SSA uses the tables to ensure that higher-income beneficiaries contribute more to their Medicare premiums. In conclusion, understanding the IRMAA sliding scale tables is crucial for beneficiaries who want to know how much they will pay for their Medicare Part B and Part D premiums. The SSA's POMS HI 01101.020 provides detailed guidance on these tables, which are updated annually to reflect changes in the cost-of-living and other factors. By familiarizing themselves with the tables and how they work, beneficiaries can better plan for their healthcare expenses and ensure that they are paying the correct premium amount. For more information, visit the Social Security Administration's website.Word Count: 500